By Jay Pelosky

In 2024, the watchword in financial markets was “American exceptionalism”, as the U.S. economy and markets left the rest of the world in the dust. But as the calendar turns, it may now be time to remove these geographic blinders to consider the larger regional competition likely to reshape the global economy in the coming years.

We may be in the midst of a long-term global growth cycle driven by intensifying competition in the critical areas of artificial intelligence, green technology, and security between the world’s three dominant regions: the Americas, Asia and Europe. (It’s what I refer to as the Tri Polar World.)

The global economy has arguably been moving toward greater regional integration since the late 2010s, when globalization stalled in the aftermath of the Global Financial Crisis and nationalism was undermined by the United Kingdom’s dismal experience following the Brexit vote in 2016.

The COVID-19 pandemic provided a tailwind to this trend, as supply lines seized up and governments realized that having ready access to medicines and vital goods was a national security imperative. This resulted in the move toward “friend-shoring” and near-shoring. The portion of U.S. companies planning to shorten their supply chains jumped from 63% in 2022 to 81% in 2024, according to a 2024 Bain Resiliency Survey of 166 CEOs and COOs.

RACE IS ON

This movement toward greater regional integration means that instead of relying on one dominant market for green technology, AI and security, all three regions may pursue industrial policies supporting investment in these areas (e.g., semiconductor fabrication plants or ‘fabs’, battery and electric vehicle plants, defense industrial readiness initiatives, etc.).

China has already led the way in its industrial policy related to green technology, representing roughly one-third of clean energy investments worldwide in 2023, according to the IEA. As a result, it now dominates much of the clean energy sector from solar cells to batteries and EVs. And Beijing appears to be utilizing the same playbook to compete in AI, as it’s seeking to develop its own semiconductor industry and reduce its reliance on the U.S.

Along the way, China has strengthened its ties with Southeast Asian (ASEAN) countries, which collectively became its biggest trading partner in 2020, eclipsing the EU and the U.S.

The U.S. has also been aggressively moving toward industrial policy under the Biden administration, with massive legislative efforts including the Chips and Science Act, which allocated roughly $53 billion to support semiconductor chip manufacturing; the Bipartisan Infrastructure Law, which has already announced over $500 billion in project funding; and the Inflation Reduction Act, which has stimulated massive private sector investment in green technology.

Today it is Europe that needs to catch up and catch up quickly. Germany has once again become the sick man of Europe, facing stagnant growth with its vaunted auto industry stuck in neutral. Germany’s fiscal rectitude is a major cause of this problem – namely the country’s lack of investment in recent decades – but this prudence could be part of the solution. With a debt-to-GDP ratio around 63%, significantly below the EU average, Germany has plenty of fiscal space to act.

OVERWEIGHTED

So what does this Tri Polar shift mean for investors?

First, it means there could be multiple drivers of global growth in the coming years originating outside the U.S.

The U.S. equity market has been the undisputed global leader since 2009. But U.S. exceptionalism is already reflected in the price of the dollar, U.S. equities and the resultant record-setting valuation spreads between the U.S. and other developed markets. U.S. equities have already posted two consecutive years of +20% returns. History suggests we shouldn’t expect a third.

With U.S. markets priced for perfection, even a modest shift in investor expectations or economic fundamentals could cause investors to rethink their high exposure to the U.S.

And that catalyst may be the incoming U.S. presidential administration.

Once Donald Trump takes office, his economic agenda could be stymied by the combination of incoherent policy, divergent views among key members of his economic team and Republicans’ slim congressional majority.

In the meantime, the other two major regions won’t be standing still.

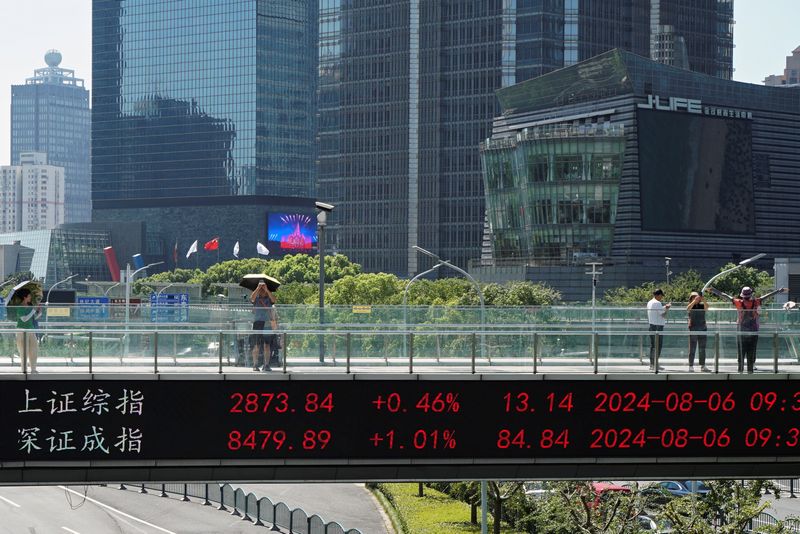

China has released a raft of monetary and fiscal stimulus measures over the last year to fight off deflation and the risk posed by Trump’s threatened tariffs. Beijing is expected to add to this cocktail at the upcoming National People’s Congress in March.

Europe, also facing a tariff threat from its top export market, could see Germany – its biggest economy – finally soften its ‘debt brake’ and employ fiscal stimulus to fight domestic stagnation.

Consequently, we anticipate a geographic broadening of both global growth and the global equity bull market in the coming year. While the U.S. will likely remain a powerhouse, investors may find that it’s not the only game in town.

(Jay Pelosky is the Founder and Global Strategist at TPW Advisory, a NYC-based investment advisory firm. Jay is the creator of the Tri Polar World (TPW) framework and the Global Risk Nexus (GRN) system.)