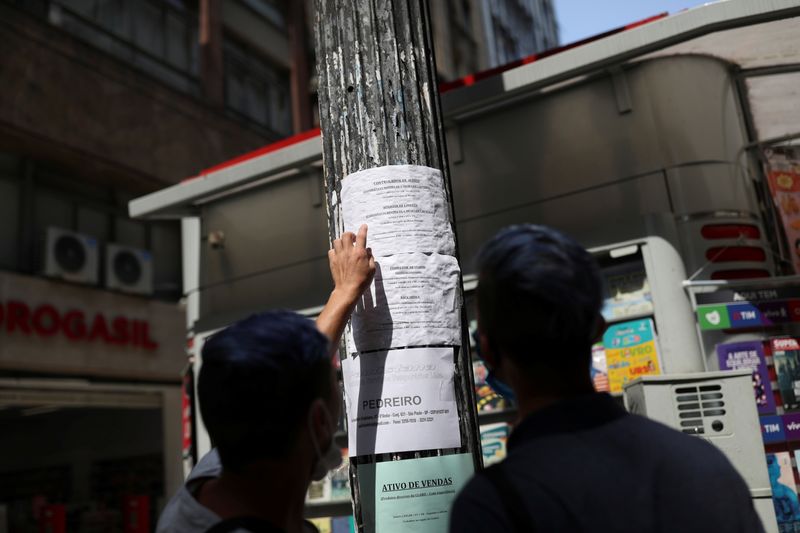

SAO PAULO/BRASILIA (Reuters) – Brazil’s jobless rate hit a fresh record low in the three months through November, official data showed on Friday, but job creation slowed to its lowest pace in nearly a year as the local labor market provides some cooling signs.

In Latin America’s largest economy, the unemployment rate stood at 6.1% in the September-November period, statistics agency IBGE said, the lowest ever in the current data series dating back to 2012.

That was in line with market expectations in a Reuters poll and down from 6.6% in the previous quarter.

Brazil’s jobless rate has been hovering around historically low levels for the past year, showing unfading strength, an indicator that has been cheered by the government although triggering inflationary concerns.

The tight labor market has contributed to the central bank’s decision to speed up interest rate hikes with a greater-than-expected 100 basis-point increase to 12.25% in December, signaling matching hikes at its next two meetings.

Providing the bank with some signs of relief in its fight to tame rising inflation, on the other hand, monthly job creation figures in the country missed market expectations and slowed to their lowest since December 2023.

Separate labor ministry data showed that Brazil created a net 106,625 formal posts in November, below the 129,500 expected by economists polled by Reuters and also the lowest level for the month in the series started in 2020.

“The labor market data indicate accommodation, which is good news for the Copom,” lender Inter’s chief economist Rafaela Vitoria said, referring to the central bank’s interest rate-setting committee.

“The scenario of a slowdown in activity is positive as it can help contain price transfers related to the recent foreign exchange rate depreciation, preventing inflation from accelerating further,” Vitoria added.

She also noted that average real wages were up 3.4% year-on-year in IBGE’s latest reading, slowing from the 3.9% increase seen in the previous rolling quarter.